Starting a business always requires a substantial financial investment for necessary procedures. The business loan is the standard and easiest way to obtain the required investment. The main question is how to get business loan in Oregon. In Oregon, there are different options for the startup businessman to get a business loan, from traditional bank loans to online loans and government programs.

Meanwhile, the loan process can be complex and challenging, but you can quickly get a business loan with preparation, planning, and guidance. So, here we will provide you with comprehensive steps on how to get business loan in Oregon with every basic step option that will help you get business loan in Oregon and succeed in your business.

Discover Business Needs

Before applying for the loan procedure, it is essential to understand that the business needs the following:

- Make sure to identify the purpose of what is known, which includes the equipment purchase, working capital expansion startup course, and more.

- You must determine the specific amount you need for your business, so it is necessary to prepare the business plan to be clear about this amount.

- Make sure about three payment terms that show how long you need to pay the loan amount or what monthly payment you can return.

These basic needs before applying for a business loan.

Find Different Loan Options

Make sure to research different loan options in Oregon for business. There are different benefits and features of the common types:

- Traditional bank loan options are good to go. It charges lower interest from the customer and provides longer payment forms that help the customers but can be challenged to qualify due to complex documentation. Thus this information helps you to get business loan in Oregon.

- Another option is a credit union, which often charges low fees and provides more personalized service than banks but has limited members. This is another way to get business loan in Oregon.

- Another great option is online loans, which have a quick application and approval process that helps the customer get business loan in Oregon quickly with more flexible criteria. However, online loans charge a high rate of fees.

- SBA Knows are government backup programs for citizens. They have good terms and low down payments, but they have a landing application process with strict requirements.

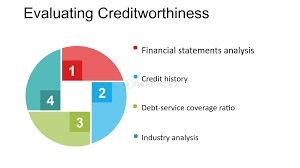

Evaluating Your Creditworthiness

Your Creditworthiness has played a significant role to get business loan in Oregon, as it is the letter that gives you access to your personal and business credit score, so it is important to improve your Creditworthiness. Evaluating your creditworthiness involves assessing several factors that lenders use to determine your ability to repay debt.

Get Business Loan in Oregon the process typically includes reviewing your credit history, which highlights your borrowing and repayment behavior over time. Lenders look at your credit score, a numerical value calculated based on factors like payment history, outstanding debts, and credit mix. They also consider your income and employment stability to ensure you have the financial means to meet your obligations.

Prepare Documentation

The lenders require comprehensive documentation to get business loan in Oregon, which is why it is essential to prepare the following documents:

- It is necessary to make an overview of the business plan and goals.

- Market research targeting market competitors is also required.

- Also, we will ensure the revenue expiration cash flow and overall final projection.

- Prepare the profit and loss statement, revenue, and expenses.

Legal Documents

Before starting a business or getting started, proper legal documents are necessary. Some important documents that are made in loan processing are a business license that proves that you are legally registered with your business and an operating agreement that overviews the structure and operation of your business.

If you have a business partner, you should have a partnership agreement. These agreements show the details of ownership and the responsibilities of both partners.

Searching for Good Lender

Once you summarize your needs and prepare the proper legal documentation, it is necessary to conduct thorough research of the lender with the following agreement rules:

- Find a trustworthy lender that will help you get the loans.

- Compare different lenders interest rates, fees, and repayment times to find the right one for your business.

- Select a suitable lender that provides good customer service that will be very helpful to you later on.

Apply for the loan

The application process depends on different lenders, but the basic steps involve the following:

- Complete the Lander application form with accurate information and be prepared to answer questions about your business idea and financial history.

- Prepare your documentation properly. You need to ensure that the documentation associated with the application is organized and accurate.

- Some landowners request additional information in the review process, so you should be ready to give the response.

Understand the loan term

Lender will give you different known options and offers if your application is approached. He needs to review clearly and understand the loan terms:

Review the interest rate, whether fixed or not, the repayment schedule, how long it takes to pay your business loan, the fees, prepayment penalties, and more. Some loans need to be considered before processing further.

Closing the Loan

Once, you agreed or enter into a closing process, which may include the signing agreement or receiving fund option into your business account. It is another fundamental factor to get business loan in Oregon.Closing a loan is the final step in the lending process, where all terms and conditions are finalized, and the borrower officially takes ownership of the loan funds.

This process typically involves a closing meeting, during which both the borrower and lender sign the necessary legal documents, including the loan agreement, promissory note, and any other relevant paperwork. The borrower may need to pay closing costs, which can include fees for appraisal, title insurance, and attorney services. Once all documents are signed and fees are paid, the lender disburses the loan funds, and the borrower assumes responsibility for repayment according to the agreed-upon terms.

Managing Your Loans

Once you receive the loan in your account, make sure to manage it properly by budgeting, tracking expenses, communicating with lenders, and more. This is essential to ensure that you manage your loan properly in every aspect and make your business profitable.

Conclusion

The most asked question is how to get business loan in Oregon. It can be a complex process, but you can quickly obtain your funds as needed with careful preparation and understanding.

Make sure to have proper documentation, research business needs, manage your loan, and have ideas for your business’s success.