Many different small business owners find it difficult to ask, “Can I rent my house to my business?” When it comes to maximizing their expenses and resources, this is the most important question posed by business owners. However, the answer is complex. Some different factors and clauses need to be and stand and look before stepping forward. Other factors like tax implications, local laws, and the nature of your business will affect this query of business people: can I rent my house to my business?

Moreover, this article will discover every aspect of renting a house to a business, the benefits, risk factors, and what you need to consider before deciding. There are different factors, resources, benefits, and more. Thus, it is important to observe all the basics before making any decision, as one decision can make your business more profitable or cause you to incur losses. So, always make sure to have a potential and paperwork decision that helps your business grow standing.

Before proceeding further, it is important to clarify what your house means to your business. Basically, this is like your personal residence or home used as a business location. You can charge your business rent and build a strong relationship between yourself and your landlord-tenant. However, this condition will help you in some financial situations and benefits, but you need to consider different factors and considerations.

Legal Considerations

There are various legal considerations in the situation where you rent my house to my business. So, it would help if you considered different factors, benefits, and legal laws. Here are some legal considerations that need to be highlighted.

Zoning Laws

Before deciding on a house for your business, check local zoning laws. Different areas have restrictions on their area, so all the specific types of companies can run from residential properties. If you own a bakery and your location is restricted to running the bakery business in a residential area, it could be against the law. That is why it is necessary to always be very careful with your local government and department to check the local zoning laws and restrictions of the areas.

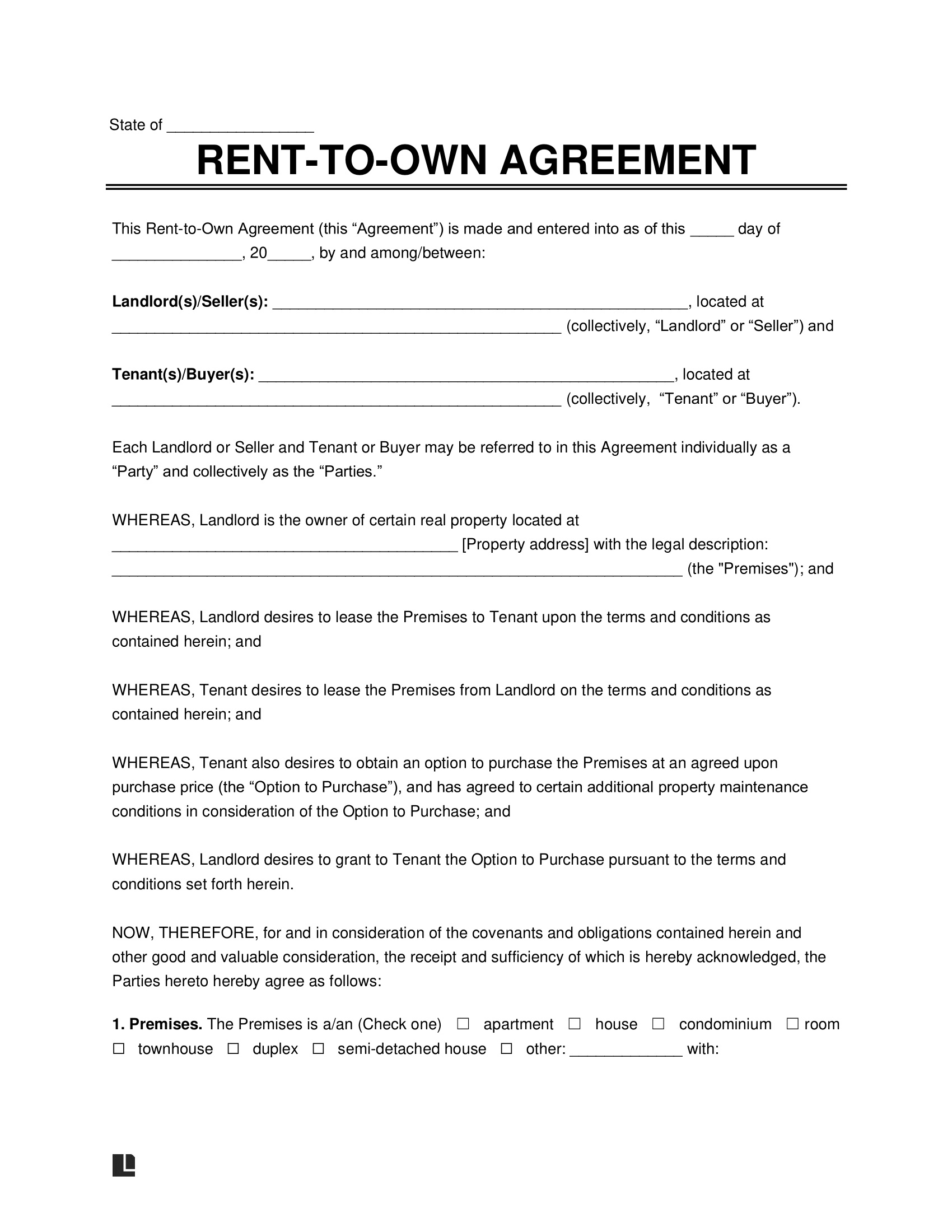

Lease Agreement

If you proceed further, there are more factors, such as creating the formal lease agreement. This agreement outlines the terms and conditions, such as rental amount payment details, responsibility for maintenance, and more. Even though you rent the residential to your business, you have to make this written agreement for legal and financial clarity. This lease agreement is the most significant document as it clarifies every rule between a landlord and a rent person. That is why please arrangements should be prepared.

Homeowner Association Rules (HOA)

Take an example like you live in a community under the HOA( Association). In that case, it is essential to check the rules. Some associations and communities prohibit joining the business from residential places and do not have any specific rules and guidelines for home-based small businesses. That is why it is essential to check the rules because going against the rules would lead to legal issues.

Tax Implications

- There are different tax implications in every area. So, ranging your tax in ifrom house to business can have different tax consequences. Let’s have a look at it.

Allowable Expenses

When you start your business from your home, different deducted expenses on your taxes include:

Rents Payment

Your business revenue can deduct the rent as a business expense, which can cost high or low depending on the location.

Utilities

If you run your business in a residential location, you have to pay for utilities. They are mostly costly and also detract from your business expenses.

Home Office Deduction

If you use any portion of your residential house for your business, you may qualify for the home office deduction.

Financial Benefits

There are various factors and benefits to renting your house to your business. Let’s have a look.

Cost Saving

One of the main factors in the execution benefit is cost savings. Rather than paying the rent my house to my business you can use a third party, it is more convenient to pay yourself. This can be more beneficial for any startup business looking to save costs.

Cash Flow Management

Rent my house to my business also gives you more benefits, like cash flow management. Collecting lines on your business makes it easier to allocate funds for expenses and investments in your business.

Risks & Drawbacks

With its advantages, there are some disadvantages, one being Western drawbacks.

Liability Issues

Running a business with hesitation can expose the company to liability. Your assets will be at risk if the customer or your property is injured. Thus they must consider guiding business liability insurance to protect myself and my belongings if a business faces leadership issues. Hence you can rent my house to my business can be considered.

Home value Consideration

It is essential to know your home when you are running a business from residential, as it may affect the resale value of your house. Some quotations might be deterred if they know the property was used for business purposes in local zones in areas that are the status, so it may affect the resale value of your house and is also linked to how you can rent my house to my business.

Complicated Relationship

However, the relationship between yourself and your business can sometimes be complicated. The relationship of rent my house to my business is quite challenging yet If you are a business facing any difficulties or financial issues, you may struggle to pay the rent of the location, which impacts your personal financial condition. That is why it is essential to consider all the factors while deciding and considering rent my house to my business.

Best Practices

Starting a small business and renting a residential place for your business such as rent my house to my business will help in different aspects of the company. Here are some best practices.

- Maintain your business record, transactions, and payments through records. That’s why it is essential to keep a record of your business. Proper documentation is also necessary. That can include tax details, utility bills, rent, and more.

- Keep your business and personal finances separate. To this end, opening a bank account for separate business-related expenses is necessary. It helps to keep the difference between personal and business.

- It is also necessary to get advice from professionals before making any decision. This will help you focus on finances, laws, rules, and more.

Conclusion : Rent my House to my Business

Rent my house to my business, the most challenging question for TATA business owners is whether they can rent their house to their business. So yes, there are different factors, benefits, and aspects that you need to consider before making any decision. Meanwhile, it is also essential to consider the tax, legal issues, and restrictions where you are starting your business. With advice from professionals making proper planning documentation, you can start your business in your resignation place. In the article, we have covered all the factors and respect that will help you write your house for your business.